Achieving financial independence requires smart planning, disciplined saving, and the right tools to manage your money effectively. The Ladda App is a comprehensive wealth management solution designed to help users automate savings, invest effortlessly, and earn competitive returns. Whether you’re saving for short-term goals, long-term investments, or emergencies, Ladda provides a seamless way to manage your finances.

In this review, we’ll explore the features, benefits, and functionalities of the Ladda App, showing how it can help you achieve your financial goals.

What is Ladda?

Ladda is a digital wealth management platform that enables users to:

- Save and invest with ease.

- Automate their savings for better financial discipline.

- Earn high returns on savings and investments.

The app is designed to cater to individuals at various stages of their financial journey, offering flexible options for both short-term and long-term financial goals.

Key Features of Ladda

1. Automated and Manual Savings Options

Ladda allows users to save as low as ₦1,000 into automated or manual savings plans. You can choose to save daily, weekly, or monthly, depending on your financial preferences.

2. High-Interest Savings

For users looking to grow their wealth, Ladda offers One-Off Savings plans with competitive interest rates. You can deposit funds as low as ₦1,000 and let your money grow over time.

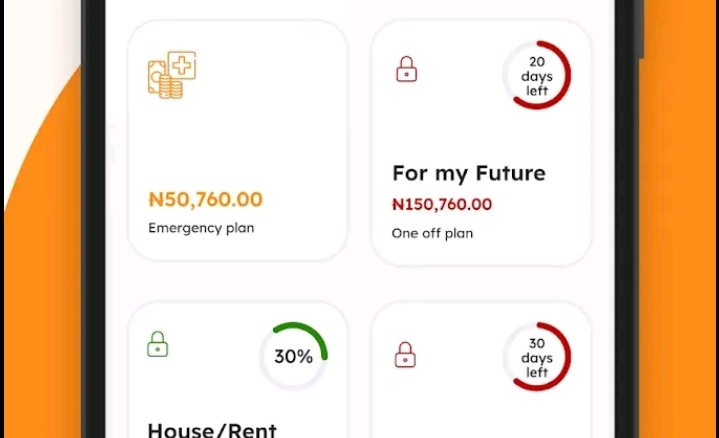

3. Emergency Fund Creation

Ladda encourages financial preparedness by enabling users to create a personalized emergency fund. This ensures you’re financially equipped to handle unforeseen circumstances.

4. Lock Savings for Financial Discipline

To help users stay disciplined, Ladda provides the option to lock savings for a set period. This feature prevents impulsive withdrawals, ensuring you stick to your savings goals.

5. Easy Withdrawals

With Ladda, you can withdraw funds anytime from your Ladda Naira Wallet directly into your traditional bank account, providing flexibility and accessibility.

6. Save for Short-Term and Long-Term Goals

Ladda supports goal-oriented savings, allowing users to save for specific objectives, such as a vacation, education, or a new car.

How Does Ladda Work?

Getting Started

- Download the Ladda App: Install the app from the Google Play Store or App Store.

- Create an Account: Sign up with your details to access the platform.

- Set Your Goals: Define your savings or investment objectives, such as short-term goals or emergency funds.

- Start Saving: Begin automated or manual savings with as little as ₦1,000.

Savings and Investment Options

- Emergency and Regular Savings: Ideal for short-term goals, with flexibility to top up or withdraw at any time.

- One-Off Savings: Designed for long-term goals, offering higher interest rates for extended savings periods.

Benefits of Using Ladda

1. Financial Discipline

The app’s automation features and lock savings options help users cultivate disciplined saving habits.

2. High Returns

Ladda’s high-interest savings plans allow users to grow their wealth faster than traditional savings accounts.

3. Accessibility

With a minimum savings amount of ₦1,000, Ladda is accessible to a wide range of users, from students to professionals.

4. Goal-Oriented Planning

Users can set specific financial goals and track their progress within the app, making it easier to stay motivated.

5. Flexibility

Ladda combines flexibility and structure by allowing withdrawals anytime while also offering locked savings for disciplined users.

6. User-Friendly Interface

The app’s intuitive design makes it easy to navigate and manage your finances.

How Ladda Stands Out

1. Competitive Interest Rates

Ladda offers stronger interest rates compared to traditional banks, making it an attractive option for savers.

2. Personalized Emergency Funds

The app’s emergency fund feature is a unique offering that promotes financial security and preparedness.

3. Automation

The ability to automate savings ensures consistency and reduces the likelihood of missed contributions.

4. Accessibility for All

With a low entry point of ₦1,000, Ladda makes saving and investing accessible to everyone, regardless of income level.

Example Use Cases

1. Saving for a Vacation

You can use Ladda to save for a dream vacation by setting up a goal and automating contributions. Over time, your funds will grow with the app’s competitive interest rates.

2. Building an Emergency Fund

Set up a personalized emergency fund to cover unexpected expenses like medical bills or car repairs.

3. Long-Term Investments

Leverage the One-Off Savings feature to grow your wealth over several years, benefiting from high returns.

Pros and Cons of Ladda

Pros

- Low minimum savings amount (₦1,000)

- High-interest rates for savings and investments

- Flexible withdrawal options

- Goal-oriented savings plans

- User-friendly app interface

Cons

- Limited investment options beyond savings plans

- No mention of specific financial advisory services

Who Should Use Ladda?

Ladda is suitable for anyone looking to manage their finances better, including:

- Students: Start saving with as little as ₦1,000.

- Professionals: Automate savings for long-term goals like buying a house or car.

- Small Business Owners: Build an emergency fund to cover unexpected business expenses.

Customer Testimonials

Here’s what some Ladda users have to say:

- “Ladda has made saving so easy for me. I love the automated feature, and the high-interest rates are a bonus!”

- “The emergency fund option is a lifesaver. It gives me peace of mind knowing I’m prepared for the unexpected.”

- “I’ve been using Ladda for a year now, and I’ve already reached my savings goals. Highly recommend it!”

Tips for Maximizing Ladda

- Set Clear Goals: Define your financial objectives before starting.

- Automate Savings: Take advantage of the automation feature to ensure consistent contributions.

- Lock Savings: Use the lock savings feature to avoid impulsive spending.

- Track Progress: Regularly monitor your savings to stay motivated.

Conclusion

The Ladda App is an excellent tool for anyone looking to save, invest, and achieve financial independence. With features like automated savings, high-interest rates, and goal-oriented planning, it’s designed to help users manage their money with ease and discipline.

Whether you’re saving for short-term needs, building an emergency fund, or planning for long-term goals, Ladda provides the flexibility and structure you need. Download the app today and take the first step toward a financially secure future!