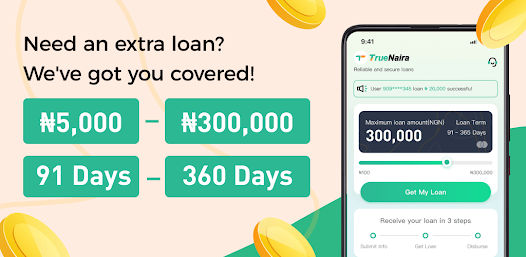

Enter the digital realm of hassle-free loans with the TrueNaira loan app, a Nigerian lending platform that provides instantaneous and unsecured loans ranging from ₦2,000 to ₦300,000. With interest rates varying between 16% and 21% per month, this blog post delves into the distinctive features and advantages of the TrueNaira Loan App, shedding light on why it stands out as a preferred choice for borrowers in Nigeria in this era of seamless financial solutions.

True Naira loan app details

| Loan amount | ₦2000 – ₦300,000 |

| Loan tenure | 30 days |

| Interest rate | 16% -21% monthly interest. |

| Age Eligibility | 18 to 60 yrs |

| Customer care number | +234 9165549808 |

How to Download APK and get a loan from True Naira Loan app

- Download the True Naira personal Loan App exclusively available on the Google Playstore and install it on your Android phone.

- Register an account with your phone number.

- Preferably the phone number connected to your BVN as a one-time password will be sent to it for verification.

- Fill in your basic know-your-customer KYC information, including your residential address, next of kin, and employment details

- You will also be required to provide your Biometric verification number BVN.

- You’ll be charged N30 to bind your ATM card to your account to increase your chances and getting a higher loan amount.

- A one-time password OTP will be sent to your phone to confirm your details.

- After the submission of your loan application, the software will analyze your credit score and the final result will be shown in the APP.

- The result should be displayed in less than two minutes and if you qualify for a loan, the loan amount will be disbursed into the bank account directly.

- Make sure you’re using a good phone with enough memory space as you will be required to take a clear live selfie for identity.

- Your BVN is linked to your credit score, so if you have an outstanding loan with other lenders or didn’t pay other lenders as at when due, expect your application to be rejected.

- Your credit score is a record of your previous borrowings, how early or late you make your payments, cash transactions going in and out of your bank account among other information.

- When you download this app you have to consent to it to get access to your phone book contacts that will serve as your guarantors, SMS to see your banking transaction records, apps on your phone to see how you use other loan apps and other details it uses to build your credit score.

Is True Naira loan app legit or scam?

True Naira is legit and gives micro loans to a maximum amount of N300,000 to customers, but has really high interest rates and bugs that prevents smooth registration. caution should be taken before taking any online loan. Always read other customer’s reviews before you apply for a loan in Nigeria.

You should know that these loan apps are not registered or regulated by the CBN or any government agency in Nigeria. You are responsible for the security of your transactions with them and there is no way to seek redress for poor customer service.

If you’re being threatened or bullied by any loan shark in Nigeria, see this Facebook group where you can find support and read about the experience of others who have suffered bullying from loan apps.

You can take steps to check and remove your BVN from the credit bureau blacklist after repaying your loans and your loan app did not automatically clear you.

Features

The True Naira Loan App offers a number of features that make it a convenient and attractive option for borrowers. These features include:

- Fast and easy application process: You can apply for a loan through the True Naira app in just a few minutes.

- Flexible repayment terms: You can choose from a variety of repayment terms, so you can find one that fits your budget.

- Low interest rates: Carbon offers competitive interest rates on loans.

- Secure and convenient: Your loan information is protected by security measures, and you can access your loan account through the app from anywhere.

Benefits

There are a number of benefits to using the True Naira Loan App, including:

- Convenience: You can apply for a loan and manage your account through the app, which is convenient and easy to use.

- Speed: You can get approved for a loan quickly, which can be helpful if you need money in a hurry.

- Low interest rates: True Naira offers competitive interest rates on loans, which can save you money.

- Security: Your loan information is protected by security measures, so you can be confident that your data is safe.

Drawbacks

There are a few drawbacks to using the True Naira Loan App, including:

- Credit check: You will need to have a good credit score in order to qualify for a loan.

- Fees: There are some fees associated with using the True Naira Loan App, such as an origination fee and a late payment fee.

- Repayment terms: The repayment terms for True Naira loans can be short, so you need to make sure you can afford the monthly payments.

True Naira loan app customer care

You can reach the True Naira customer care number on 08032334405. or email truenairanigeria@gmail.com