Zenka Loan App 2023 Review

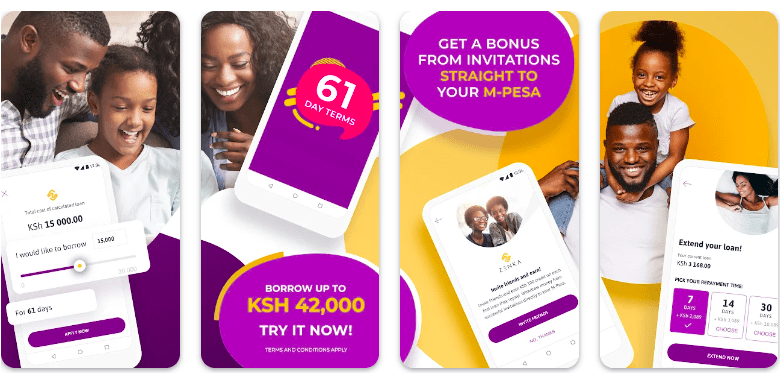

Zenka is a Kenyan loan app offering short-term personal loan services up to KSh 50,000 disbursed instantly into your Mpesa account. Interest rate is 9-39% on a 61 day loan that can be extended up to 12 months.

Zenka Loan Limit

The loan limit for Zenka in Kenya is currently between KSH 500 to KSH 50,000.

Customers can express a preference for loans of 61 days. Zenka 61-day loan payment terms have an interest fee of 9-39% with a Processing Fee that ranges from KSh 45 – KSh 5,800 for a one-time charge with an APR: of 180%*.

How Can I get Zenka Loan through SMS

If you rather not use the Zenka loan app to borrow money, here is how to get a Zenka loan through SMS. However, this method is only available for Safaricom users in Kenya:

- Dial the Code *841#

- Then, Enter your 4-digit MPESA PIN

- Next, Check the Zenka loan application information about cost and terms

- Then, Pick one of the available terms

- You” get a payment link, Follow the link and wait for an SMS notification for your Zenka loan.

What to know about online personal loans

Online loans can be a convenient option for funding a purchase in a pinch, but they should not be taken lightly. Applying for a personal loan means that upon approval, you’re agreeing to repay your loan amount, plus any interest, within the term given. And payments start as soon as the full amount is disbursed into your bank account. Short-term loans are very expensive and should only be used for emergencies, they should not be used to fund one’s lifestyle.

Alternatives to online loans

Online loans often comes with the easiest requirements to get. However, depending on your unique situation, credit profile, and financial goal, other types of debt may be more favorable. Some alternatives to online loans include:

- Credit cards: Credit cards are a type of payment card that allow you to borrow against a line of credit to make purchases, transfer balances from one credit card to another—or even pull out cash from an ATM using what’s called a cash advance. Average APRs for credit cards stand at just over 20%, according to the most recent figures from the Fed. Average rates for personal loans stand at 11.48%.

- Personal line of credit: A personal line of credit is a predetermined amount of money that you can borrow from (up to the limit) for a given period of time, referred to as your draw period.

- A loan from a friend or family member: If you have a friend or family member who is willing to lend you the money interest-free or at a lower rate, with flexible terms, this may be the most cost-effective option. Of course, it’s important to set clear terms from the start and adhere to those terms to avoid any potential fallout.

- A home equity loan: A home equity loan allows you to borrow against the market value of your house and receive a lump-sum payment in return. Even if this option comes with a slightly lower interest rate, it involves significantly more risk than a personal loan if you fail to repay your loan.