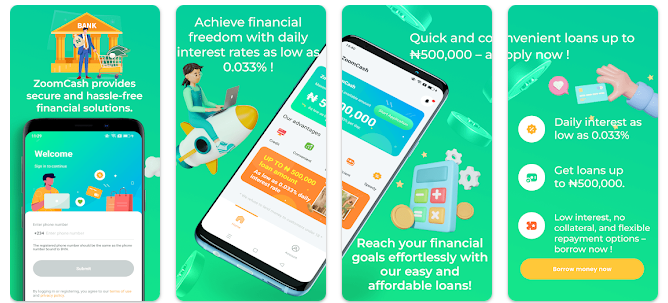

ZoomCash presents itself as a trusted Nigerian loan app designed to support low-income earners and blue-collar workers with fast, short-term loans. The app claims to offer secure, affordable financial support with flexible terms and competitive interest rates. But is it really the helpful solution it promises to be?

This in-depth review breaks down ZoomCash’s loan structure, user experience, and real customer feedback to help you decide if it’s worth your time—or your trust.

Key Features of ZoomCash

- Loan Amount: Up to ₦500,000

- Loan Tenure: 91 to 360 days

- Annual Percentage Rate (APR): Up to 12%

- Service Fee: 5% of the loan amount

Example Calculation:

For a ₦500,000 loan over 240 days:

- Daily interest: 0.033%

- Total interest: ₦39,600

- Service fee: ₦25,000

- Total Repayment: ₦564,600 (₦500,000 + ₦39,600 + ₦25,000)

ZoomCash markets its interest rates as relatively low, especially compared to many other Nigerian loan apps with APRs exceeding 100%. On paper, this is a plus.

Eligibility Requirements

To apply for a ZoomCash loan, you must:

- Be a Nigerian citizen

- Be at least 18 years old

- Have a stable source of income

No collateral is required, and the entire application is done online via the app.

Security and Privacy

ZoomCash claims to use high-level encryption and secure data protocols. It assures users that personal information is strictly for verification purposes and will not be shared without explicit consent.

How to Apply for a Loan

- Download the ZoomCash app

- Register with your phone number

- Complete the application form and upload required documents (such as ID)

- Submit the loan request

- Wait for approval and disbursement

Zoomcash Contact Details

- Email: help@zoomcash.cc

- Number: 09088765565

- Address: 86A, Oduduwa Crescent, Lagos, Nigeria

Real User Reviews: Does ZoomCash Deliver?

Despite its attractive terms, ZoomCash has received overwhelmingly negative feedback from users on the Google Play Store. Here’s a breakdown of the most common experiences shared by borrowers:

1. Disbursement Issues

Balikis Isa (April 5, 2025):

“I applied for a loan successfully, but I’ve not been credited since yesterday. The app already shows a repayment schedule.”

Thomas Adebiyi (Jan 5, 2025):

“They approved ₦7,000 and sent a message saying it’s disbursed, but nothing hit my account. Yet they expect repayment.”

This is one of the most repeated complaints—users report that ZoomCash shows loans as approved or disbursed, yet the money never actually arrives.

2. Excessive Charges on Small Loans

Blessed Udin (Mar 16, 2025):

“You gave me ₦3,500 and expect ₦6,800 back after a week? The charges are ridiculous.”

Despite advertising a 12% APR and 5% service fee, many users claim they were charged much higher effective rates, especially on smaller loans.

3. Low Approved Loan Amounts

Ado Yusif Zambur (Mar 27, 2025):

“After giving them all my data and even my international passport, they gave me ₦5,000. I deleted the app immediately.”

Applicants often complain about spending time completing the process only to receive very small loan approvals.

4. Poor Customer Communication

Olabisi Arike (Jan 2, 2025):

“You approved my loan and didn’t send the money. Yet you’re already telling me to repay. Don’t call me—I will blast you.”

The lack of communication or clear contact channels for resolving issues is a major pain point for borrowers.

5. Mixed Feedback on App Functionality

Albert Toba (Feb 18, 2025):

“The application process is easy and smooth.”

Some users praise the interface and signup process. However, many note that the app malfunctions after approval or shows misleading information.

Iremide Abeke (Feb 2, 2025):

“They ask too many questions like I’m borrowing ₦1 million, yet approve nothing. Waste of data.”

Pros and Cons of Using ZoomCash

Pros:

- Loan terms and interest appear competitive (on paper)

- Easy online application process

- No collateral or physical paperwork needed

- Claimed strong data security

Cons:

- Frequent disbursement failures

- Low approval amounts regardless of documentation

- Inconsistent or excessive charges

- No accessible or responsive customer support

- Repayment reminders before money is received

- Mixed reliability of app performance

Is ZoomCash Legitimate?

ZoomCash does not list FCCPC or CBN licensing information on its app or official contact points. While this doesn’t mean it’s illegal, it raises transparency concerns. Coupled with poor user experiences, the app’s legitimacy is questionable despite its professional presentation.

Should You Use ZoomCash?

Consider using ZoomCash only if:

- You’re testing with a very small loan amount

- You are fully prepared to handle repayment even if funds aren’t credited on time

- You have tried other reputable lenders without success

Avoid ZoomCash if:

- You need money urgently

- You expect professional customer service

- You’re concerned about data privacy and loan scams

Better Loan Alternatives

Given the reliability issues with ZoomCash, you might consider:

- Carbon – Transparent terms and responsive support

- FairMoney – Fast disbursement and user trust

- Branch – Consistent approval and clear loan breakdowns

Final Verdict

ZoomCash promises affordable credit for low-income Nigerians but fails to deliver on many fronts. Disbursement inconsistencies, lack of transparency, and poor customer support make it a risky choice, even with its low advertised APR.

Final Rating: 1.5/5 – Appears promising, but trust is a serious issue. Borrow cautiously or look elsewhere.