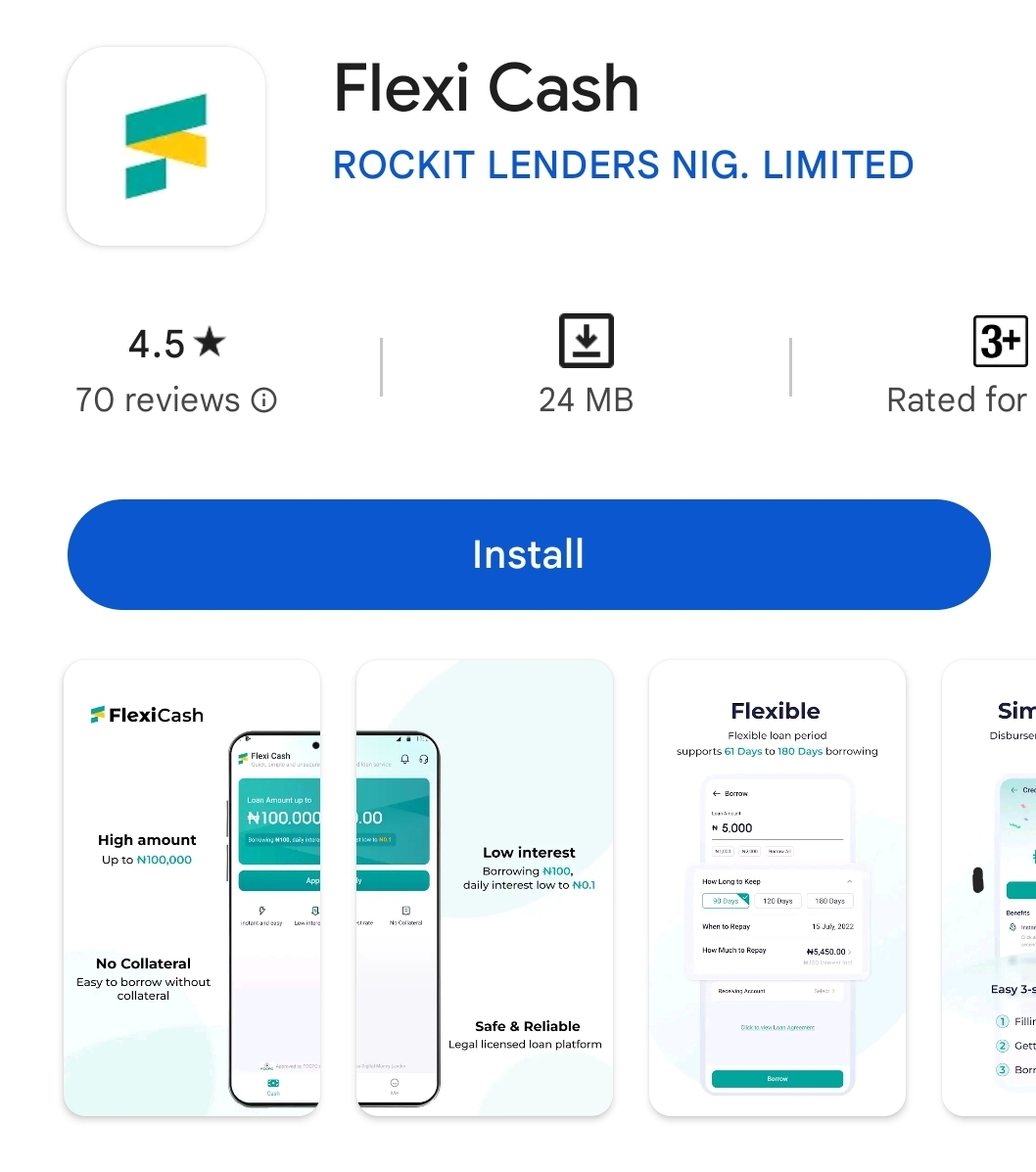

FlexiCash loan app is a Nigerian app that offers instant and unsecured loans of up to ₦100,000. Interest rates range from 16% -21% per month. This app is a stand alone loan app that is not affiliated with PalmPay, Palmpay has its own in-app short-term loan service also called Flexicash.

app details

| Loan amount | up to ₦100,000 |

| Loan tenure | 7-30 days |

| Interest rate | 6% to 24% monthly interest. |

| Age Eligibility | 18 to 60 yrs |

| Customer care number | customer service telephone numbers:018886888 Email: support@fleximfb.com |

| Office address | 1, COURT ROAD, OPPOSITE ECWA CHURCH, KARU, Abuja, Federal Capital Territory, 900108, Nigeria |

Is Flexicash loan app legit or scam?

Flexicash loan app is legit and does give short-term loans to qualifying borrowers. Some customers have left a positive review on the app’s Google store page, while others complain of not getting a loan after registration. To get a loan, your credit score will be considered, if you have outstanding loans from other lenders your application will probably be rejected.

Caution should be taken before taking any online loan. Always read other customer’s reviews before you apply for a loan in Nigeria.

Because there is no regulations in Nigeria, most of these apps are loan sharks who might threaten to send messages to your family members calling you a scammer if you default on your repayment. It is best to avoid these apps if you have other options.

If you’re being threatened or bullied by any loan shark in Nigeria, see this Facebook group where you can find support and read about the experience of others who have suffered bullying from loan apps.

You can take steps to check and remove your BVN from the credit bureau blacklist after repaying your loans and your loan app did not automatically clear you.

How to Download APK and get a loan from Flexicash Loan app

- Download the Flexicash personal Loan App exclusively available on the Google Playstore and install it on your Android phone.

- Register an account with your phone number.

- Preferably the phone number connected to your BVN as a one-time password will be sent to it for verification.

- Fill in your basic know-your-customer KYC information, including your residential address, next of kin, and employment details

- You will also be required to provide your Biometric verification number BVN.

- You’ll be charged N30 to bind your ATM card to your account to increase your chances and getting a higher loan amount.

- A one-time password OTP will be sent to your phone to confirm your details.

- After the submission of your loan application, the software will analyze your credit score and the final result will be shown in the APP.

- Your BVN is linked to your credit score, so if you have an outstanding loan with other lenders or didn’t pay other lenders as at when due, expect your application to be rejected.

- Your credit score is a record of your previous borrowings, how early or late you make your payments, cash transactions going in and out of your bank account among other information.

- When you download this app you have to consent to it to get access to your phone book contacts that will serve as your guarantors, SMS to see your banking transaction records, apps on your phone to see how you use other loan apps and other details it uses to build your credit score.

What other borrowers are saying about Flexicash loan app

here are some testimonials from other borrowers who have used the Flexicash loan app:

“Flexicash has been a lifesaver for me! I needed a quick loan to cover unexpected medical expenses, and their application process was seamless. The funds were deposited into my account within hours. Highly recommended!” – Emily S.

“I was skeptical at first, but Flexicash exceeded my expectations. The app was easy to navigate, and the customer support team was extremely helpful. I got the loan I needed without any hassle. Thank you, Flexicash!” – John W.

“Flexicash is a game-changer! As a small business owner, I often need funds for inventory and equipment. With Flexicash, I can access affordable loans with flexible repayment options. It has truly helped me grow my business.” – Sarah L.

“I’ve tried other loan apps before, but Flexicash is by far the best. Their interest rates are competitive, and they offer personalized loan options based on your financial situation. I highly recommend giving them a try!” – David H.

“Flexicash made the loan application process stress-free. The app is user-friendly, and the approval decision was quick. Plus, their transparent terms and conditions gave me peace of mind. Great service overall!” – Lisa M.

Read more customer reviews before downloading any loan app.Is Flexicash the same as palmpay?

Flexicash loan app is a stand alone app that is not affiliated with Palmpay. Although, PalmPay also has its own in-app short term loan emergency service called flexicash, the app reviewed in this blogpost is not related to PalmPay.