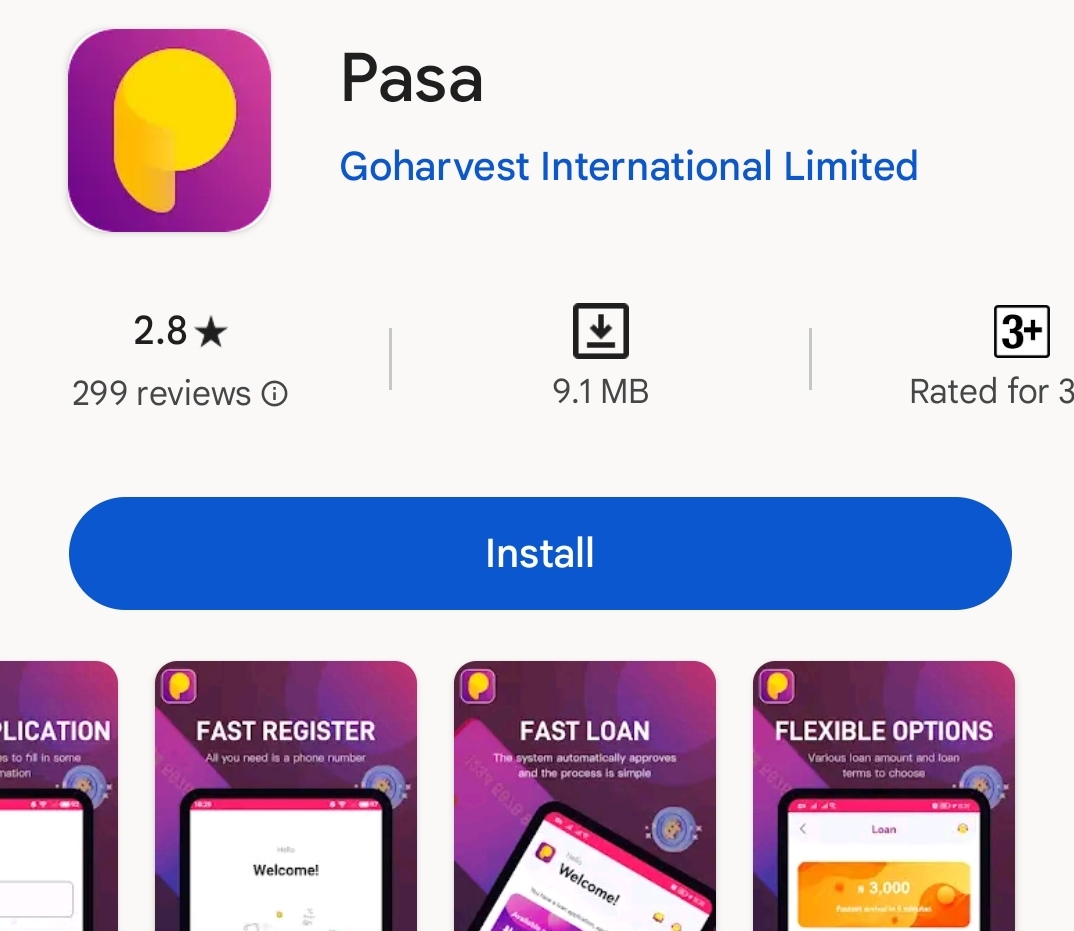

Pasa online loan app offers fast growing instant personal loans. Borrow money, wherever, whenever. Nigerian citizens with BVN and bank account can get the loan without collateral.

Pasa Loans makes it easy for consumers to apply for an unsecured personal loan. Prospective borrowers can check their rate and determine eligibility without a hard inquiry on their credit report, and those who are approved can apply online and receive funding as soon as the same day.

An unsecured loan is a type of loan that does not require collateral to get. It is usually short-term with very high interest rates. Do not take an online loan to fund your lifestyle, they should only be used for short-term emergencies.

PROS

• Fast approval and funding.

• Low interest rates compared to other lenders.

• Good and responsive customer support.

CONS

• Minimum loan amount is low especially for new borrowers.

• Requires a long credit history.

• No prequalification process.

• Very high interest rates on short-term loans.

• Short loan repayment term starting from just 5 days.

• Bugs that prevent smooth loan application. Consider other apps if you’re in a hurry.

How to Download APK from Pasa Loan app

• Download the Pasa personal Loan App exclusively available on the Google Playstore and install it on your Android phone.

• Register an account with your phone number.

• Preferably the phone number connected to your BVN as a one-time password will be sent to it for verification.

• Fill in your basic know-your-customer KYC information, including your residential address, next of kin, and employment details

• You will also be required to provide your Biometric verification number BVN.

• You’ll be charged N60 to bind your ATM card to your account to increase your chances and getting a higher loan amount.

• A one-time password OTP will be sent to your phone to confirm your details.

• After the submission of your loan application, the software will analyze your credit score and the final result will be shown in the APP.

• The result should be displayed in less than two minutes and if you qualify for a loan, the loan amount will be disbursed into the bank account directly.

• Make sure you’re using a good phone with enough memory space as you will be required to take a clear live selfie for identity.

• Your BVN is linked to your credit score, so if you have an outstanding loan with other lenders or didn’t pay other lenders as at when due, expect your application to be rejected.

• Your credit score is a record of your previous borrowings, how early or late you make your payments, cash transactions going in and out of your bank account among other information.

• When you download this app you have to consent to it to get access to your phone book contacts that will serve as your guarantors, SMS to see your banking transaction records, apps on your phone to see how you use other loan apps and other details it uses to build your credit score.

Is Pasa loan app legit or scam?

Pasa loan is legit and gives micro loans to a maximum amount of N300,000 to customers, but has really high interest rates and bugs that prevents smooth registration. caution should be taken before taking any online loan. Always read other customer’s reviews before you apply for a loan in Nigeria.

You should know that these loan apps are not registered or regulated by the CBN or any government agency in Nigeria. You are responsible for the security of your transactions with them and there is no way to seek redress for poor customer service.

If you’re being threatened or bullied by any loan shark in Nigeria, see this Facebook group where you can find support and read about the experience of others who have suffered bullying from loan apps.

You can take steps to check and remove your BVN from the credit bureau blacklist after repaying your loans and your loan app did not automatically clear you.

How Pasa loan determine eligibility

Like most online loan apps, Pasa loan uses an AI aided algorithm to determine your credit score limit and makes you a loan offer in minutes. If your BVN has a history of poor loan repayment, you might get a low offer or get no offer at all. You can try again after you’ve cleared your loans with other lenders.

Pasa Interest Rates

• The rate of interest charged is between 3% monthly to 9%.

• The interest charged depends on the loan quantum, profile of the customer, tenure of the loan, and other factors.

• The interest charged varies from customer to customer.

• The interest will be charged only on the amount withdrawn.

• Repayment: The repayment period is flexible and ranges from 7 days to 3 months.

• Security: This is an unsecured loan and so no security is stipulated.

• Processing charges: 2% of the loan amount.

What Pasa provides:

※

Age requirement: 18 – 65 years old

Personal Loan Amount: ₦10,000 to ₦ 500,000

APR:Maximum 36% per annum

Minimum repayment period offered = 91 days

Maximum repayment period = 180 days

No Hiding Fees

For a borrower who takes out a personal loan of ₦10,000 within a 91-day period and makes payment on the 91st day, the following charges will be charged:

Total interest payable: ₦ 10,000 * 36%/365 *91= ₦ 897

Repayment amount (loan amount + interest): ₦ 10,897

Pasa loans are for short-term emergency use only. The loan is a personal loan and borrowers who need long term loans should consider other options.

Does Pasa require ATM card?

Yes, Pasa requires you to bind your ATM card to your account during registration. The card will be automatically charged when it is time to repay your loan. You can make loan repayment before due date.

Pasa provides short-term loans for emergency use only. Do not rely on online loans to fund your lifestyle or business. They are short-term and have very high interest rates.

Alternatives to online loan apps in Nigeria

While online loan apps offer quick and convenient access to funds, there are times when exploring alternative avenues for financial assistance can be more advantageous. The biggest drawback to most online loan apps in Nigeria is that they are very expensive with high interest rates. Over reliance on loan apps can lead to even bigger financial problems if not managed properly. here are some alternatives to online loan apps to consider before taking a loan.

Savings or Emergency Funds: In times of financial need, dipping into your own savings or emergency fund might be a prudent choice. While it’s important to have a dedicated emergency fund, using these funds can help you avoid interest payments associated with loans altogether. Remember to replenish the fund as soon as possible after your financial situation stabilizes.

Family and Friends: Seeking financial assistance from family or friends can be an alternative worth considering. While borrowing from loved ones comes with its own dynamics, it can often be interest-free and more flexible in terms of repayment. Make sure to establish clear terms and maintain open communication to avoid any misunderstandings.

Side Hustles and Gig Economy: If you’re facing a temporary financial setback, exploring opportunities in the gig economy or taking up a side hustle can provide a source of extra income. Platforms like freelancing websites, ride-sharing apps, or food delivery services allow you to earn money on your own terms and schedule.

Before pursuing any alternative, it’s crucial to assess your financial situation, create a budget, and prioritize your needs. Each alternative comes with its own advantages and considerations, so take the time to evaluate what aligns best with your circumstances and goals. Remember, making informed financial decisions is key to achieving long-term financial stability and well-being.

Pasa loan customer number

Phone number WhatsApp line: 09088653161

Service hours: 9:00 – 16:00

Email: pasaservice@gmail.com

Address:9 Jibowu St, Jibowu 101245, Lagos